Since spring 2022, cryptoland has seen a number of meltdowns and bankruptcies. The frequency and magnitude of these failures highlight how susceptible bilateral cryptoasset transactions are to credit risk, never mind the lack of robust risk control and management. Navigating markets in 2023 will require institutional quality risk management – in particular counterparty risk.

This survey was conducted during Quantifi’s recent webinar, ‘Crypto Credit Risk – Lessons Learnt’, at which Wilfred Daye, former, CEO, Securitize Capital was guest speaker. More than 160 individuals from across the finance industry registered for the webinar and were invited to take part in the survey.

Key findings

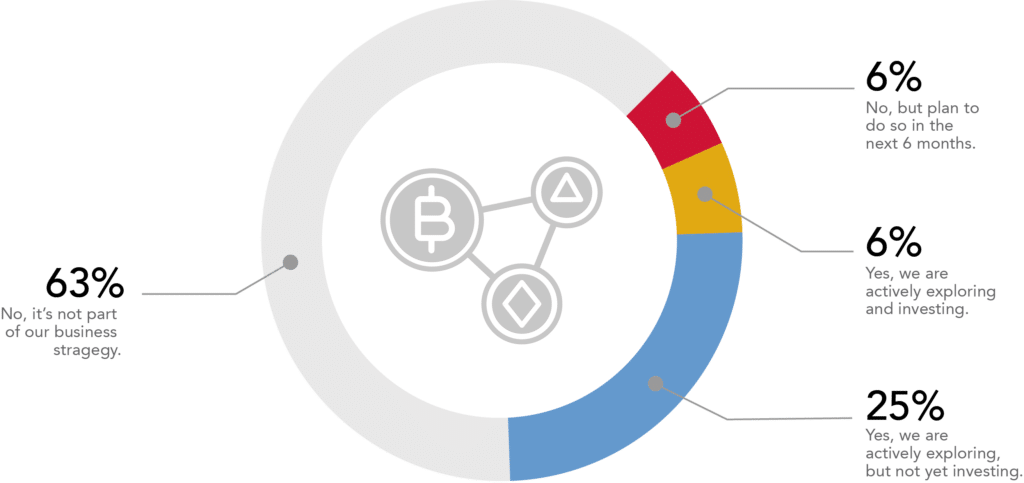

Is your firm exploring the use of cryptoassets?

While cryptoassets have great potential as additional alternative sources of alpha with the prospect of outperforming traditional banking products by offering greater efficiency and more transparency, 63 percent of respondents remain sceptical of the value of crypto as an asset class. In 2022, cryptoassets underwent considerable levels of volatility and their reputation has been tarnished with the collapse of several high profile hedge funds, namely Three Arrows Capital and FTX. The former, a Singapore-based hedge fund, borrowed $3.6 billion to finance huge bets on cryptocurrencies and digital tokens. When the cryptomarket crashed, the firm defaulted on the loans, taking two of its lenders – Celsius and Voyager, both of which filed for bankruptcy.

Only 6 percent of firms are grabbing a piece of the multitrillion cryptomarket by incorporating cryptoassets in their portfolios. Another 6 percent are actively exploring and investing in cryptoassets. Others (25 percent) are adopting a wait-and-see strategy.

What do you consider to be the highest risk associated with cryptoassets?

The growth of cryptoassets has the potential to raise financial stability concerns and increase risk. Several cryptoassets have exhibited a high degree of volatility and present several risks, including market, liquidity, credit and operational. Credit/counterparty risk (38 percent), followed by market risk (31 percent), is the main risk that respondents associate with cryptoassets.

The global financial crisis of 2008 underscored the importance of credit risk in the financial markets. Although rarely considered in the same context, the cryptoasset industry is not immune to credit and counterparty risk. The frequency of failure highlights the susceptibility to credit risk.

It is expected that financial institutions, service providers and investors will continue to dedicate resources to build a robust infrastructure and develop or select suitable risk solutions to manage the counterparty risk of cryptoassets. Even though trading cryptoassets presents significant challenges, through technology, regulatory development and comprehensive risk management, these challenges can be minimised. With cryptoasset industry evolving at pace, firms must not only be smart about the risks cryptoassets pose but also manage them accordingly.

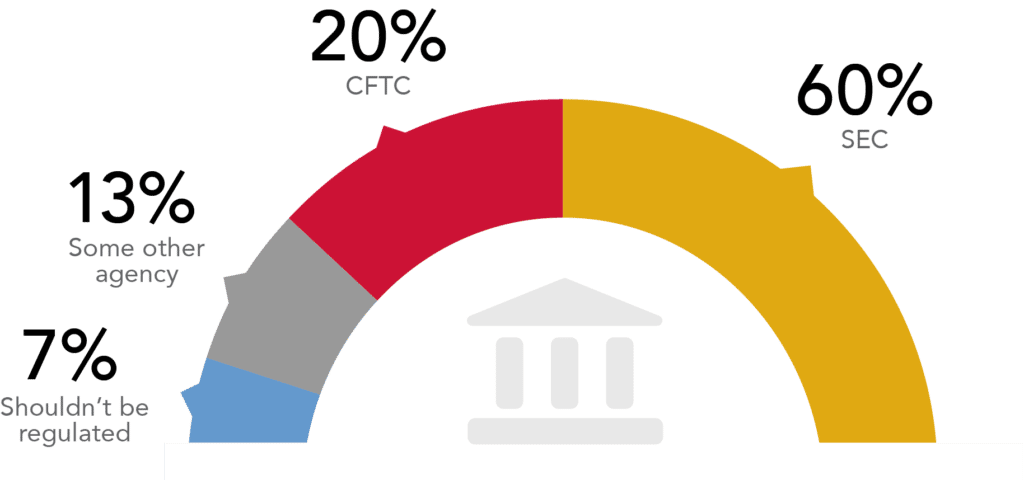

Which agency should regulate cryptoassets in the US?

The growth of cryptoassets in the financial markets has raised the question of which regulator should primarily regulate crypto-related activities in the US. One side of the argument is that as cryptoassets are subject to securities laws, they must operate within the US Securities and Exchange Commission (SEC) scheme. The other side argues that the SEC has no authority – unlike the Commodity Futures Trading Commission (CFTC) – over pure commodities or trading venues, whether those commodities are gold, wheat, oil or cryptoassets. Therefore the CFTC should expand its authority in the digital asset market to ensure the market and the underlying technology can be utilised without unnecessary harm to customers and financial market stability.

The majority (60 percent) of respondents agree that the SEC should be responsible for regulating the market. Only 20 percent of respondents feel that the CFTC should assert its jurisdiction in cryptoassets.

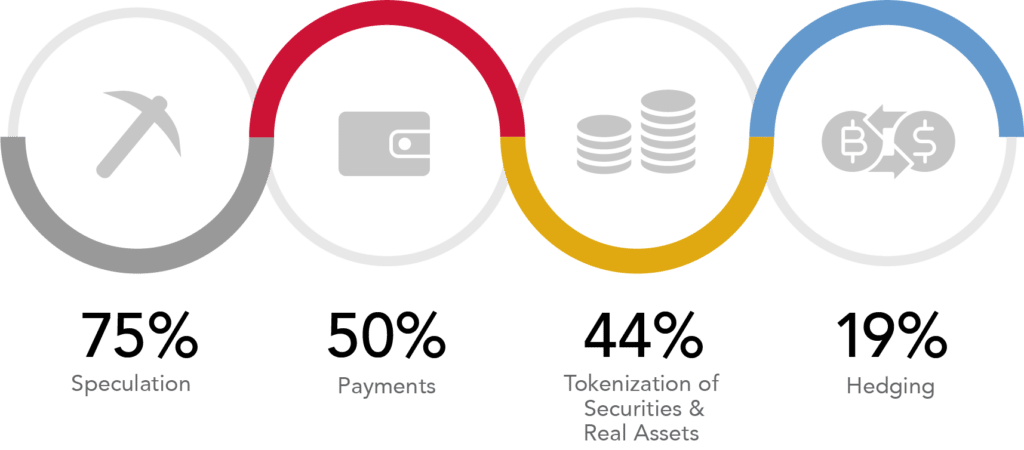

Which of the following do you think crypto assets are a vehicle for?

Cryptoassets can serve different functions, some of which mirror those available in the traditional financial sector. The technology underlying cryptoassets has the potential to bring a number of benefits including payment system operability and reduced transaction costs. Investors see cryptoassets as risky instruments. Cryptoassets typically have high long-term average volatility, which makes them attractive for speculative trading activities. It is considered a speculative asset due to volatility and the fact that it does not serve a primary purpose.

Speculation (75 percent) was cited as the most common vehicle for cryptoassets. Payments (50 percent) was noted as another use case, followed by tokenisation of securities and real assets (44 percent). Cryptoassets, most likely Bitcoin, are also used as macro-hedges. Since cryptoassets are traded 24/7 globally, they are used to express views when equity is closed for the day or during the weekend. This is a ‘proxy’ hedge.

The crypto crisis of 2022 will delay institutional adoption of cryptoassets by?

Given the uncertainty and wave of collapses within the emerging industry, there are fears that the highly volatile cryptomarket will echo the financial crisis of 2008. The downfall of FTX has no doubt damaged crypto’s reputation and may set back progress towards wider acceptance. However, most (67 percent) participants feel that the 2022 crisis will only delay institutional adoption by one to two years; 27 percent of respondents anticipate a delay of two-plus years, while only 7 percent feel there will be no delay.

The crypto crisis must be a wake-up call for regulators to hold the industry and its executives accountable. Some in the industry believe that unless stringent new regulations are introduced, the market could spark a financial meltdown on a global scale.

Conclusion

Cryptoassets have become a big talking point internationally. They represent a seismic shift in the financial markets and have grown in popularity. The technological advancement behind cryptoassets has come a long way and has the potential to disrupt the financial system as we know it. Central banks and other financial institutions can play a key role in shaping this landscape.

With credit risk being one of the three main risk categories that cryptoasset traders face, it is expected that financial institutions and investors will continue to dedicate resources to build a robust infrastructure and develop or select suitable risk solutions to manage the counterparty risk of cryptoassets. Even though trading cryptoassets presents significant challenges, the general view is that through technology, regulatory development and comprehensive risk management, these challenges can be minimised. With the cryptoasset industry evolving at pace, firms must not only be smart about the risks cryptoassets pose but also manage them accordingly.

Although the cryptomarket crash of 2022 was not on the same scale as the global financial crisis, there are certainly lessons to be learned from it.