Effective LDI management requires advanced and flexible risk analytics tools that provide accurate hedging of risky assets versus liabilities. The right tools allow firms to make better matching and hedging decisions as they can perform cash flow projections, on-demand sensitivity analysis and agile scenario analysis and stress testing. Best-in-class tools are also designed to stay abreast of evolving regulatory requirements that require cash flow matching, sensitivity calculations, collateral planning and robust scenario analysis.

Comprehensive risk analysis and hedge effectiveness

Risk analysis is the foundation of an effective LDI program as it helps gain visibility on the downside of the different investment strategies. A key element of the analysis is the evaluation of various risk factors that influence a portfolio’s funded status and how they affect the ability to meet the ongoing payment of liabilities. These risk factors have significant influence on a firm’s investment strategy, hedging and rebalancing decisions.

Powerful curve building and instrument modelling

Robust curve-building capabilities are becoming increasingly crucial for LDI managers, particularly as market practices and regulations change. For example, over the past few years LDI teams have shifted to OIS discounting and included collateral availability and uptake in investment decisions. This makes it necessary for firms to adopt more sophisticated curve-building frameworks. Flexible curve building is essential for LDI teams trying to achieve the most competitive pricing when executing their investment strategy. This includes being able to build curves across multi-asset and multi-currency portfolios by incorporating OIS discounting and CSA multi-curve discounting.

Cash flow matching

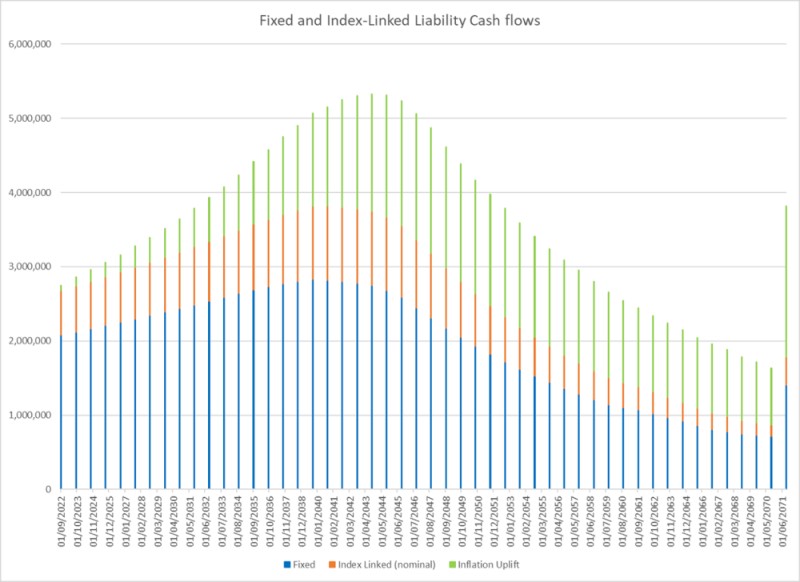

The ability to view cash flows is an important part of understanding the risk of failing to meet a fund’s liability obligations. Typically, cash flows are fixed, however some are uplifted for future inflation based on different inflation indices and formulas, potentially with caps and floors on the index uplift.

Pension fund liability cash flow schedule, plotting fixed payments and index-linked uplifts

Cash flow modelling allows Chief Actuaries, Chief Investment Officers and Chief Risk Officers to best model the risks that need to be hedged, including interest rate, inflation, credit and equity risk factors. Sophisticated risk solutions such as Quantifi can manage both vanilla and exotic contracts, so portfolios can be created and cash flows managed irrespective of the underlying instruments.

Inflation sensitivity for assets and liabilities

Scenario analysis and stress testing

A risk architecture that includes a flexible scenario analysis framework is essential for portfolio managers. Scenarios that can be created to drill down into risk drivers can help a firm enhance its LDI strategy. An ideal solution would also include prebuilt stress tests and the functionality to create customised scenarios, reflecting user-defined risk metrics (such as inflation, interest rate duration, PV01, IE01 and credit spread according to tenor ranges set by the firm). All in all, this provides comprehensive risk analysis and visibility into the performance in addition to the risk profile of a given investment portfolio.

An integrated view of assets and liabilities

To satisfy the risk requirements introduced by regulations such as Solvency II and to improve business performance, insurers and pension scheme managers need a unified view of all their assets and liabilities. Having a thorough understanding of the relationship between assets and liabilities and the risk technology to manage them enables firms to make more strategic risk and hedging decisions. This in turn allows them to pursue more promising investments and better service collateral requirements.

The above requires a solution that provides extensive instrument coverage, from vanilla to exotic. A sampling of these includes:

- Interest rate instruments: forward rate agreements (FRAs), swaps, caps and floors, and swaptions

- Bonds and notes: zero coupon bonds, callable bonds, index-linked bonds, asset-swapped bonds, inflation swaps, convertible bonds, floating rate notes and cross-currency swapped bonds

A complete solution for LDI decision-making

To support an LDI strategy, firms require a sophisticated valuation and risk analytics solution such as Quantifi to help manage liability risk, make the right investment decisions and satisfy regulatory requirements.

In addition, the solution should be scalable to support the growth of a portfolio, without the overhead or downtime of building out new pricing capabilities. Solutions that take an integrated approach to data and curve management provide consistency by ensuring everyone involved in the LDI strategy uses the same curves and related assumptions. For scaling up across portfolios and multiple clients, embedding the LDI analytics in a cloud-based risk management service improves audit trails and reduces operational risk and costs. As a complete LDI decision-making solution, Quantifi makes it easy for firms to achieve their funding targets while successfully navigating business, market and regulatory change.